Oct 30, 2009

The “C” shaped recovery:

Are you pat down with the “V” shaped recovery or perhaps the “U” shaped recovery? Or perhaps, you’re attuned to stair stepping model of recovery that is headed to the dungeon of doom (nefarious toothless grin on my face)?

As you might gather from the dates between the last post and this one, I’ve been so long in the dungeon of doom, it is so dark there, that I’ve made only the slightest efforts to surface albeit with a severe case of decompression. I am decompressing actively now and hopefully I don’t get an acute case of the bends.

I still maintain my bearish bias but in the dark corners of the dungeon, one doesn’t really know whether one is amongst many or accompanying the few that remain. The last two months have been a veritable siege on my sensibility and not to mention stability. In retrospect, this was to be expected as I was well aware that there is no end to the machinations of an administration (any administration) hell bent on righting a sinking ship. While the previous administration might have protested that the ship was not sinking but it was that the storm was raging, this administration notes that while the storm has passed, there are so many tropical paradises nearby that you’d do well to use this straw to get from here to there. The more articulate ones have even begun to say that getting wet is the point of sailing. Meanwhile, “Full steam ahead.”

This is no critique of this administration because no administration save a brazen one could create sensibility when it has been jettisoned wholesale (or as a serving of humble pie a moi – offer sensibility where it is lacking. My sensibility, I confess, was lacking because I didn’t recognize the true extent of the power of government but I’m young and can be forgiven my insistence on comeuppance – well, that’s my “cop out” apology sort of thing). And this administration, like those before it, are brazen dispensers of promises and promissory notes – a brazenness more banal than breathtaking, partly because it is so predictable. While uncertainty is a staple, even necessary, when it comes to the machinations of countless parties, second parties and third parties in a web of agreements, only the steadfastness of that nameless bureaucrat and his ilk can save our world – for obvious reason: in that his chief means – power, is balanced by his chief virtues – ignorance and stability. The bureaucrat is ignorant because he was never a party to nameless and faceless agreements and his career is a glorious hymn beginning “Don’t rock the boat, baby.”

It must come a sigh of fresh air to a bureaucrat when a cursory sampling of the latest uproar on his table reads, “Extravagant bonuses at bailed out banks, unemployment and regulatory loopholes.” These are the bread and butter of a bureaucracy – incompetence, corruption, ad hoc rules, fly by night consultations and visitations – what bureaucrat is unfamiliar with those, thses can be dealt with, even swiftly if the overlords in the political world so desired it. What a bureaucrat cannot deal with is “Value”.

To illustrate, chain a man to a treadmill with rules and regulations – now, that is an easy thing in and of itself. The cheery bureaucrat will write himself a bonus for this task and no doubt countless pages of regulation that no one other than his cousin the lawyer would ever read. Why a man would run on a treadmill of his own accord – that is a secret that a bureaucrat cannot ever hope to fathom? So what does he do in the face of the latest tumult, order more treadmills and more importantly, more chains.

But this is not a question of sensibility (there’s that bearishness creeping right back in). When the agents of the government go on offense, even in a haphazard way as is their wont, even style, you’d better take note. My pocketbook took a lot of hits because I insisted on reason – governments, as I have been educated, insist on a different kind of reason.

So how have our fearless bureaucrats sought to return us to health? “Get on into more debt, young man,” blares every program in some form or the other. Take a look:

- The stimulus (and all others to come) – borrow against future tax receipts but spend it today.

- Cash for clunkers – Destroy a working (polluting?) car and go into debt for a new one with a little help from us – save the earth, save on oil but tie this chain around your neck.

- Homebuyer’s credit – The first $8000 is on us, the next sum of an order 100 times our bait is on you – go into debt for the sake of cycling those homes through the market, er, no better time to buy a house.

- FDIC is broke – This program which operates through the fees collected from the participating banks is floating a plan to have its members pre-pay up to three years of future dues in order to resume its mission of finding, taking control and then reopening failing and failed banks.

And the list goes on and on. Which of these spell restraint, awareness of the system or something wise? If we were reckless getting to this point, the administration responds with another form of recklessness getting out. The constant is a yearning for the halcyon days of but a few years ago (which having lived through were anything but) and the method of madness is to get into debt. Draw me a fine distinction, if you will, between

(a) the worry free days of getting into debt during the housing bubble that has just revealed a chain of corruption, wheeling and dealing all the way from the mortgage officers right through Wall Street and into the books of government backed institutions such as Fannie Mae and Freddie Mac

(b) government enticing homebuyers with a credit and saddling them with homes the value of which they are certain would crater if they didn’t endeavor this way to get their citizenry into debt. Of course, if the home prices still declined, though at a lesser pace, we would revisit this same issue a few years later.

In an insane world, if a bunch of guys were determinedly pouring water into a sinking ship, they would be keelhauled without delay. However, in this sane world, determined guys can pour more water into a sinking ship by pointing out that only then would the ship’s pumps be fully utilized. Furthermore, this is widely praised as distinguished public service.

So what then of the recovery, “V”, “U”, “L”, “W”. twenty two letters to go? To me, this is a “C” shaped recovery i.e. “Consumer” shaped recovery. I’m in the least concerned about the shape of the recovery. I’m more concerned about the consumer, the customer – the true end point of every supply chain. From my vantage point, talk about the shape of the recovery treats the consumer as the animal that he is (as in the repository of the animal spirit) – to be whipped onto the next treadmill of consumption and debt until he collapses.

And this is my contribution to the masters of the supply chain universe – if you can, for a minute, get away from the forecasts of recovery, and the talk of priming the supply chain pump, long lead times, weak dollar and what have you, and ask yourself – how is my customer dealing with a drawdown in credit lines, loss of equity in his home, chopped liver in his 401K.? In looking at the coverage of the consumer and businesses, we have gone from “Things are terrible” to “Things are bad”. However, now, I note an impatience to getting to “Things are great” while I’m expecting a “Things are not so bad” followed by “Things are Ok” followed by “Things are not so bad” followed by “Things are Ok”. The policy actions of this administration and the next would set the direction of that cycle in motion and there is every evidence that we’re gearing up for more spending, more debt, pressure from creditor nations and so on.

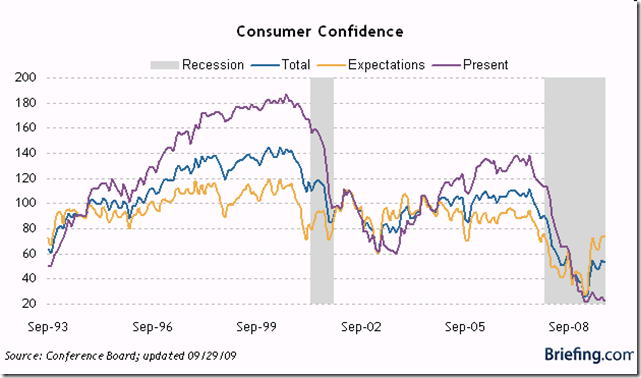

So is there any evidence of a consumer recovery? Yes, there is some but it is by no means something that presages significant improvement and the petering out of some of the extant stimulus programs should impact consumer confidence negatively going forward. As it stands now, note the rebound from the all too widespread feeling that went along the lines of “The world is ending,”:

There was a slight decline in September 2009 and as they note,

Consumer sentiment indices get way too much attention. The simple fact is that sentiment does not correlate strongly with consumer spending and thus has little predictive value. Consumer spending correlates more closely with income. Sentiment tends to reflect well known factors such as unemployment rates and gas prices more than it predicts future spending patterns.

Meanwhile, Romer: Impact of stimulus will wear off (Christian Romer is a top White House economist) notes,

A top White House economist says spending from the $787 billion economic stimulus has already had its biggest impact on economic growth and will likely not contribute to significant expansion next year.

But I thought the bulk of the stimulus effect would be felt in 2010 and not in 2009 – What’s the deuce here? As this CNN story notes from January 2009: Stimulus will take a while to work.

All in all, the legitimate infrastructure spending, which in its expanded form would include Obama’s ambitious plans to invest heavily in renewable energy sources, will most likely not start coming on line until the fourth quarter of the year and its full effect is at least 12 to 18 months away. In other words, the fiscal stimulus measures that the incoming Administration will be pushing through are more a 2010 story.

And as for numbers of jobs created, A look at the effect of stimulus on States notes

Economists on both sides of the debate agree that the actual number of jobs created by the stimulus package will likely never be known. Large swaths of stimulus money went to provide tax relief, extend unemployment benefits and provide fiscal relief to beleaguered state government budgets. These programs have largely indirect effects on employment.

Only about a third of the stimulus funds – some $275 billion – are going to grants, contracts and loans that will be tracked on Recovery.gov. The 30,000 jobs reported so far cover only direct contracts, which represent $16 billion of that total.

So what can one conclude from this sorry state of affairs? What can one say about the “C” in the “C” shaped recovery? In a post a little while back, I had noted that there will be many more stimulii in the pipeline and one can already see the trial balloons being floated for them.

However, there is another “C” in the “C” shaped recovery – the Corporation. That will be next.

Note: I contributed this post to the Sourcing Innovation Blog as well.