The headline read: UPS plans air deal with DHL in US, the byline of which is,

UPS plans up to 10-year air deal with DHL within the US, expects $1B in added annual sales

Only, I don’t think that it is UPS’s plan – It sounds more like DHL going around with a bowl in hand. That’s too dramatic? But, the roots of this story goes back about 5 years – a failed strategic acquisition/strategy and the resultant. Where do I read that? Right from the same story,

The arrangement with UPS is part of a U.S. restructuring announced by DHL parent Deutsche Post. DHL is slashing network capacity in the U.S. by 30 percent, which includes closing and consolidating sorting facilities and streamlining pickup and delivery routes. The company did not say how many employees would be affected.

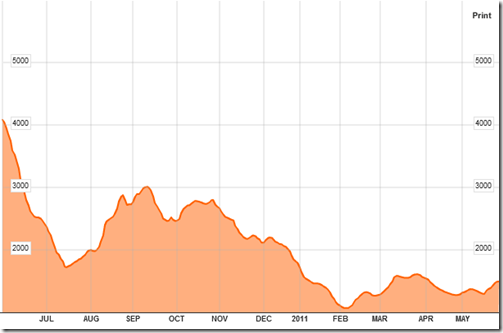

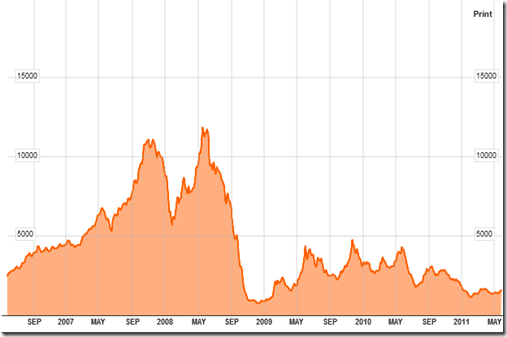

DHL’s U.S. business has posted repeated losses and slipping sales as it continues to lose market share to UPS and FedEx Corp.

That is the real story within the story but to get that I think a little background is in order. Back in 2003, DHL acquired Airborne Express for a little over $1 billion USD. At that time, this deal was considered a strategic acquisition by DHL and Deutsche Post (DHL’s parent company and the privatized German Postal Company) in order to expand into the US market.

The long and short on the impact of DHL- Airborne (3/18/2004)

DHL’s American Adventure (11/29/2004)

At that time, one of the critical decisions made with Airborne’s assets was to keep its ground assets including the sorting facility in Wilmington, OH but spinning of Airborne’s air assets into a separate company – now known as ABX Air. This might have been a critical error but the decision might have been forced at DHL (DHL deal with UPS could end thousands of jobs in Ohio)

When DHL bought Airborne Express in 2003, it spun off its airline into the independent ABX Air because DHL, owned by Deutsche Post AG of Germany, was not allowed to own an American airline.

So up until the UPS air freight deal, DHL contracted ABX Air and ASTAR Air Cargo to shuttle the packages across the country. The statement from ABX Air when apprised of this deal reads:

"We cannot now determine whether those negotiations will lead to an agreement, or what other steps DHL might consider to reverse its losses in the U.S.," Joe Hete, chief executive of Air Transport Services Group, said in the statement. "In the meantime, we intend to continue to perform under our current agreements with DHL while aggressively pursuing our strategy of expanding our business with other customers,based on the technical and cost advantages of our fleet of advanced Boeing 767 cargo aircraft."

So clearly, DHL seems to be hurting from using ABX Air and possibly ASTAR Air Cargo – but in what way? It might very well be the case that UPS is able to leverage its economies of scale better than ABX Air and/or ASTAR Air Cargo. Or it could be that operational costs at the Wilmington hub are relatively higher and DHL’s declining volumes could be handled within its own sorting facility. So what got DHL to this point? That’s what I want to know and went looking for. The starkness of the headlines you read about this story these days compared with the big splash headlines back in 2003 contrast like night and day. While it is certainly wise to read comments posted on an internet board with a grain of salt – when two and two are put together, you ought to get four:

I departed in late 2006 amid a series of ill-advised and puzzling moves. The first and biggest blunder of DHL in the US was their decision to dismiss all but one of the former Airborne executives after a very brief transition. The ineptitude of the DHL senior management team was clearly demonstrated early on with a mindset that DHL was now a big player in the US market. They added on an unprecedented cost structure almost immediately; layers of personnel,new hubs, IT changes, significant service upgrades, etc, without the benefit of a dramatic increase in shipments. Airborne was methodical and cost conscious, so the culture was very unfamiliar and local managers often received conflicting messages regarding service and cost: a balancing act of two goals that can be mutually exclusive.Essentially, DHL brought on the cost structure of a FedEx sized company with Airborne-sized revenue and units. Almost overnight they began to offer premium service to thousands of new zip codes in the US regardless of potential revenue, just to say they can compete head-to-head with UPS and FedEx.

and,

Lastly, the consolidation of the two air hubs was ill-timed and poorly executed. The concept was correct, but the plan for it (short timeline, no test runs, incomplete sort facility in Wilmington ) was faulty and the project failed from the outset. I personally was there that first night to watch it unfold (while unloading containers and sorting packages). Tugs were lined up 20 deep waiting to offload aircraft containers; sorters stood for 10 minutes ata time waiting for packages; some slides were empty while others overflowed onto the ground in piles up to 6 feet high with no shift of labor from one to the other. Most shift supervisors were new and in experienced. The new sort facility was designed for a larger container type and workers were unfamiliar with how to process them.Packages were backed up for weeks while aircraft departed well under capacity due to the inability to process the containers in a timely fashion. Much of the backup was finally shifted to ground transfer to help catch up with the backlog, but not until the second week. By then,many major shippers had already rerouted their shipments to competitors. Many of them never returned.

These snafus correlate very well with the personnel management changes at the highest level at DHL Express USA. So the story so far as I see it for DHL Express USA:

1. Big splash.

2. Very deep pool – barely swimming, maybe drowning.

3. Latch onto a shark to swim to the other side.

But what is DHL supposed to do now?

Tags:

Or rather on my plate. I want to draw your attention to these two challenges that are floating out there in cyberspace – prize money being offered for your (my) troubles as well if one contributes something of value:

1. The first one is the older of the two – The Netflix Prize, which is a problem in improving the accuracy of the movie recommendation system that is used by Netflix (in addition to several other ecommerce sites). This is something that I started working on before I got deluged at work but I hope to pick up the pieces again and make a try.

2. The second challenge is being offered by ROADEF, the French Society of Operations Research – which is to use OR techniques in Disruption Management for Commercial Aviation. I’m sure that if you fly these days, you’d appreciate a little succor from such sources and I’m glad that people are being invited to contribute towards solving this problem. Since I’m working in applying optimization to such problems, this is something I definitely will consider working on.

So, any takers?

Tags: Optimization Challenge, Netflix Prize, ROADEF, Disruption Management in Commercial Aviation

Outsourcing Reverse Logistics is a recent article posted Modern Materials Handling.com that has an interview with Tim Konrad of GENCO (my former employer) – it’s a niche for GENCO that it has been rather good at exploiting . He notes the following key points concerning reverse logistics as practiced by a 3PL:

Do it in volume

Establish vendor agreements

Implement a software package

Receive, inspect and dispose

Reconciliation

If you wanted to know what happens to a product that you returned for whatever reason: