May 20, 2010

‘Scuse me but who sprung the volatility back?

I’m about as far as anyone can get from the professed purpose of this blog i.e. Supply Chain Management. However, there is a method to this peripatetic diversion that is biased to anything but Supply Chain Management. The truth, according to me, is that it really doesn’t matter whether you’re sourcing in China or India, or whether faulty gas pedals are being found in the Lunar Rover now or how Cadmium and Miley Cyrus’s jewelry came together and made their way hand in hand onto Walmart’s shelves.

What does matter though is the fire that is being stoked in the world’s markets? And the world of the supply chain is very tightly linked to this world market but one link removed.

Think for a minute in the sense that the world financial markets didn’t exist and we only had the physical market at hand. It would be an easy tell about the interconnectedness of the supply chain and the physical exchange and transfer of goods over the counter. But back to the real world, the financial markets act as an intermediary in the financing of production and transportation of goods (and of late services) all over the world and their direction to markets all around the world, valuing everything from the debt of governments as well as the stability of firms engaged in the very production of goods and so on. And right now, there is an epic battle being waged as to the control of these markets. And not for one minute are the powerful parties in this struggle disinterested parties to the outcome. The three parties to this struggle are the financial firms and banks that control (at the behest of their clients of course) huge amounts of capital, governments that supposedly represent their citizenry and control enormous tax receipts and perpetual debts or the general public that have their retirements and houses on the line here. The truth is that only the last party to this struggle has but a squeaky voice in all of this and is also the weakest link.

Yet, in all our theoretical supply chain hokum, it is the consumer that is the main driver of everything – and here in lies the troubling dislocation. The consumer is in dire straits and without a rebounding job market or ever rising asset class that can spring some liquidity, there’s just not enough juice to keep all of the supply chain links functioning.

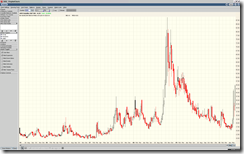

I’m laughing right now (false bravado, really) but I posted the below graph to the day (See my blog post on April 27th: Two conflicting reports: Who decides?) of what must have been the sunniest day this side of the great recession. Compare the two charts of volatility, one from the last post and one from today.

| April 27th, 2010 | May 20th, 2010 |

|

|

And a close up of what has transpired in the last thirty days set against the recent past, below is the VIX from the beginning of the year:

That is nothing short of an explosion of fear in the financial markets. Do you feel the fear yet in the supply chains? It is coming.

And a quote from the previous post:

“I’m certainly interested in spending now that the stock market seems so relaxed,” said Dan Schrenk, an information technology consultant, as he stood outside a Best Buy store in the Portland suburb of Beaverton.

I wonder how Dan Schrenk is feeling today?

And how does my consequent statement look like:

As the left side of the above chart shows, complacency can last quite a long time and so cannot be read to indicate that something altogether violent and volatile is impending.

Well, I was wrong because something violent and volatile was brewing and it just made a first visitation. Now, we get to see how those Animal spirits will hold up. We also get to see, what this administration has in store for us and also what their allies in power all over the globe as well. I can hazard a guess, they will double down, even triple down their reckless attempts to save us (and their ill-gotten and ill-deserved gains). But given how far they’ve held up the sun, you can almost be sure that they can hold up the moon for at least half as long.

Now as for supply chains, you can be sure that if you’re not tabling business continuity plans that take into account financing, transportation and manufacturing disruptions, political games, street riots, tariffs, protectionism and the like, you’re about to get a rude awakening. I thought I’d never say this but Inventory is about to be king and the customer, well, he’s a serf now.

Supply chains, especially those that have become enormously complex over long distances don’t have to exist – it is not an iron clad feature of human experience. In fact, it might even be a bug – it hasn’t existed in human history but for the brief blip that has been this three decade or so experiment as well as the Silk Road but that had quite a different structure altogether.

Say it aloud, these supply chains don’t have to exist. And that’s the truth. Maybe, a different sort of supply chain will spring up – local and short instead of global and long. Or something else entirely.

So in the big picture, this sophistication in supply chain structure, technology and management is relevant because the scale and scope has been expanding these last thirty years and at a tremendous pace. As the need to understand, manage and control has grown, so has the need been met in this particular fashion. The promise of future continuing growth in both scale and scope is premised on reaching the unwashed masses – or those who are yet to attain to our supposed state of development. Yet, there is not any universal law of progress that dictates that it should be so – we could head in the other direction i.e. devolve to the state of underdevelopment of those we planned to grown to envelop.

So this is very much like a locomotive that is running at break neck speed on a track that is only being laid as the engine rolls forward with a lever attached to the locomotive itself. What’s more, we find that the need for speed has been met only by burning up the coaches that were once attached to the locomotive. Very soon, there will only be an engine running on inertia towards a track that is at an end.

[…] ‘Scuse me but who sprung the volatility back? Supply chains, especially those that have become enormously complex over long distances don’t […]