Aug 21, 2013 5

Red alert! Red alert! – Supply Chain Prediction 2013 is beginning to materialize…

Earlier this year in Feb 2013, I had made my prediction for the Supply Chain of 2013 – You can read it here in : Predictions for the Supply Chain in 2013.

In that post,

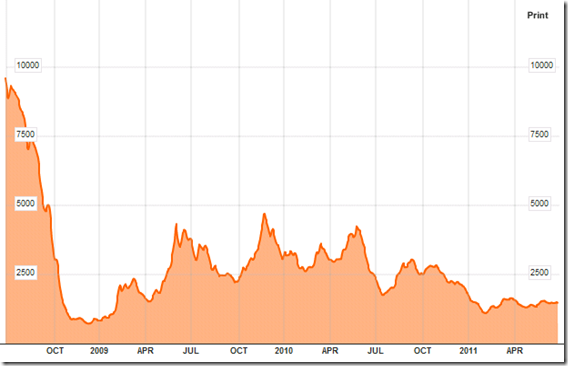

Well, I have my prediction too for the supply chain of 2013 (and 14 and 15 too). If anything I’d call it the rise of the Supply Chain Currency Wars. The first shot of this new phase of global currency wars was launched by Japan a week or two ago. While it will start slowly, over the next few years, this sort of tit-for-tat devaluation will play havoc with global supply chains especially the one’s with finely tuned cost calculations justifying the location of factories and/or distribution centers.

Devaluation of currencies over a matter of couple of quarters and in-kind retaliation is going to drive up financing risk in the supply chain. Were such a scenario to come to pass, then supply chain operators need to nail down some other variables so as not to have all the variables in a supply chain in a volatile flux.

Big Data – Nyet. Bigger and Badder visualization – Not a chance.

Increased volatility, upset cost calculations – Yes, sir – that’s for breakfast, lunch and dinner around the corner. Almost all the Emerging Market countries (such as BRIC) have entered a period of flux, not unlike what the Nutty Market countries at the periphery (Egypt, Syria etc) entered into roughly 2 years ago. This flux in the Emerging Markets – both China and India have received a lot of foreign investment in the past years.

So take one scenario : As projected growth and real growth decline, these countries will be subject to capital outflows. This is why, devaluation of the currency is the only way out for countries that constitute the manufacturing base of the world – the hope would be that devaluing their currency makes their exports cheaper and thus keeping the growth engine going. However, this is a problem for all other developed countries other than the US.

Capital outflows from emerging markets need to go somewhere. Where? You have only two choices – Bonds or Equities (well, there’s a third – Dollars). As the Fed ramped up talk about tapering the Quantitative Easing, yields have spiked for US Treasuries. Remember that if the yields spike too much, governments at all levels in the US (local, state and federal) will essentially stop functioning as they have promised to i.e. the inability to finance and roll over maturing debts at spiking rates. Equities have doddering at ever higher and higher valuations – buying into the markets at these levels is asking for trouble.

If it is bonds that these capital outflows crowd into – yields come down and everything is kicked down the road for a few more years. If it equities that these capital outflows crowd into – the markets are buoyed for a little longer with the attendant desire for the wealth effect that the Fed has been hell bent on creating.

Then the cycle reverses again intolerable equity valuations or dampened yields force capital outflows from the US back outwards in search of return.’

So what do Currency Wars mean for the supply chain? Take your pick: Disruptions, Volatility, Uncertainty, Wild swings in valuations and costing, Sourcing variations that inevitably lead to quality variations.

In one word : Variability. That’s the bane of any operation.