Its been a few months of good (or rather better) news on the employment front – the employment situation being a lagging indicator implies that the economy is on the mend and has been so for a few months. So what is the divergence then? See here below:

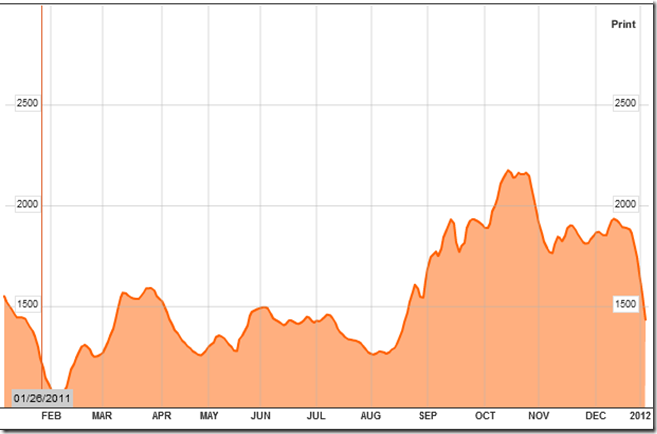

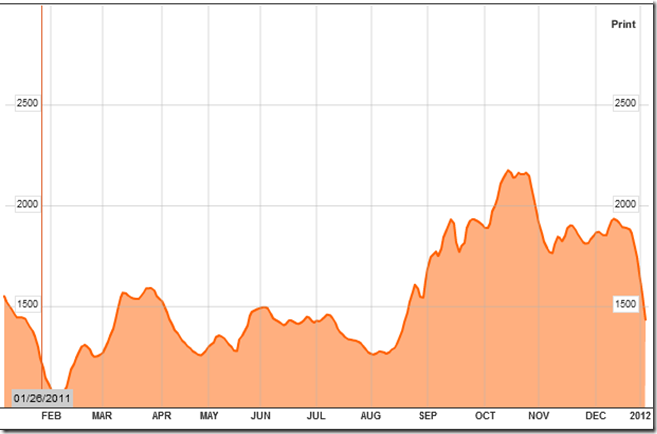

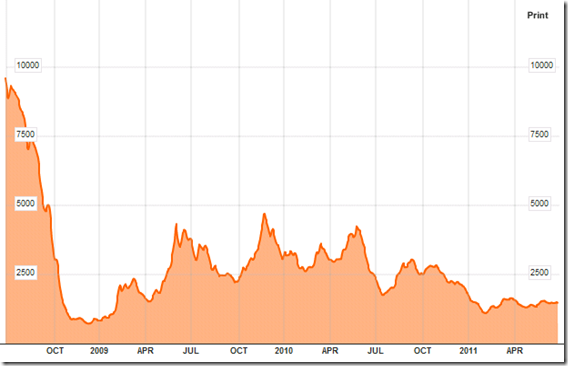

This is the Baltic Dry Index (BDI). You can see the steady build up that kicks off in August 2011 and continues till about Nov 2011. After that, it drops precipitously going into 2012. Now isn’t that a puzzling divergence? Well, it isn’t if you think that the general economy is going to tank again but can you really say that with today’s picture, today’s expectation – rosy getting rosier?

Well, at the very least I get to check whether the BDI is any good as an indicator?

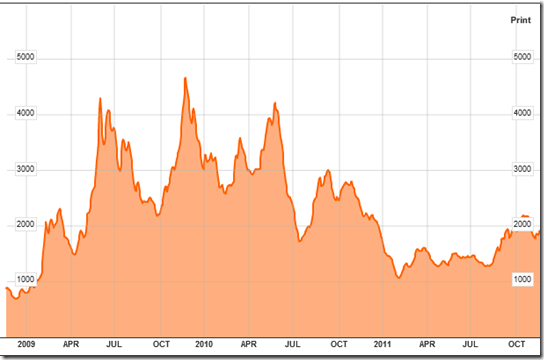

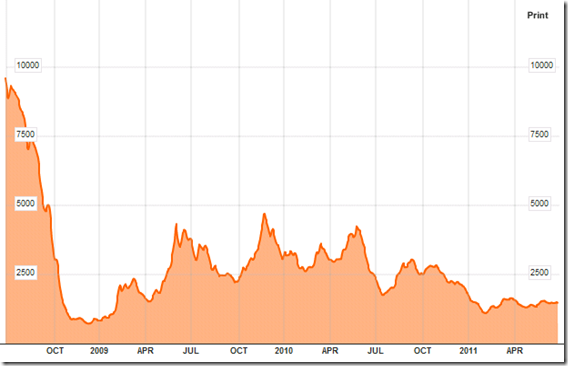

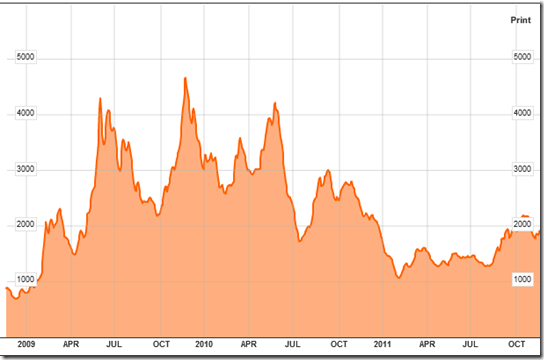

Periodically, I revisit the Baltic Dry Index (BDI) from time to time to get a read on economic activity as read from the volume of shipping contracted across the world. The following is a 3-year chart from 2009 onwards.

As you can see, the stimulus lead spurt of activity also reflected in the economy starting in early 2009 that began to peter out at the beginning of 2011. Then starting from August 2011, the index records a slight improvement in activity but nothing to write home about. While it is early to rule in an oncoming recession, it would take only the slightest worsening of the crisis in Europe to send all the economies of the world reeling once again.

No good news here. But as long as there’s no terrible news either, we slink on.

In an earlier post, I blogged about the Baltic Dry Index as a good indicator of economic activity (Read it here: Ready for a recession?)

Even if we were to magically start moving in the Baltic Dry Index in a positive direction which would be a tremendous relief for everyone (but remember – *magically*), the US treasury and the Federal Reserve would continue to devalue the US dollar for two practical reasons:

1) Repay outstanding debts with a depreciated currency. This is really quid pro quo with some of the trading partners of the US against whom the US has been running trade deficits for the better part of a decade. The whole point of trade is not for one side of the equation to accumulate a lot of paper currency but to reciprocate in buying the origin country’s exports.

2) Make US exports competitive with other countries and reignite production/manufacturing stateside.

In fact, if the US (and World) economy were to recover some what, the above two agencies would devalue the US dollar with a vengeance.

This sort of policy, if successful, would mean a repatriation of some of the manufacturing that went overseas. Going further, when US firms look at the scenario (albeit a few years down the line) and see that the assets created overseas for manufacturing whatever widgets were outsourced have depreciated or is in need of upgrades to remain viable, that would be the decision point for deciding where the next generation of manufacturing will be located.

Much of the trajectory of what we see taking place goes to answering that question of the future and the above two agencies are hell bent on creating conditions that answer this question of manufacturing in the positive.

Or so I believe.

In such a scenario, what I believe to be key to long term competitive manufacturing is the ability to be smart about manufacturing – it means being able to operate using a very thin buffer for error because American firms will be competing with overseas firms (firm benefiting from their own countries’ competitive devaluation) that will continue to compete on large volumes and scale.

So what is Smarter Manufacturing?