Aug 15, 2008 0

JDA acquires i2

JDA is all set to acquire i2 Technologies for approximately USD $346 million – the huger for scale is relentless, it seems but whether or not it succeeds is a different matter altogether.

Aug 15, 2008 0

JDA is all set to acquire i2 Technologies for approximately USD $346 million – the huger for scale is relentless, it seems but whether or not it succeeds is a different matter altogether.

Feb 16, 2007 0

SDExec.com reports on the results of a survey carried out by Maxager. The principal finding of the survey was,

Many manufacturers believe that it is important to measure the speed at which products are made, but very few have systems in place to do so

The survey results amply show that while everyone is aware that there is a problem, few have a solution:

The survey results showed that although respondents overwhelmingly (92 percent) believe that analyzing the speed with which they produced profitable products was important, 71 percent don’t have software or systems in place to do so. The result is that very few manufacturers (5.7 percent) have the ability to use a metric that is aligned with return on assets (ROA).

Here is a snapshot of Maxager’s solution to the problem:

Combining production velocity with margin produces a profit-per-minute metric. Being time-based, this metric is directly linked to ROA. It can be used at an operational level to measure the profitability of individual products, customers, deals, markets, sales regions, salespeople and production facilities. Then, everyday decisions about which products to make, who to sell them to and where to make them can be made collaboratively to maximize annual corporate profits and ROA.

What do you think? Does it work?

Tags: Metrics, Maxager survey, SDExec.com, Production velocity, ROA, Return on Assets

Feb 13, 2007 0

SCDigest reports on strong rumors about merger talks between IBM and SAP.

These are just rumors, to be sure, and have been circulating at some level for almost a year.

SAP has strongly denied the rumors during that time, though chairman Hasso Plattner unintentionally put some fuel in the fire last May by saying to the German Financial Times last year that: “There are only three potential buyers [of SAP]: IBM, Microsoft and Google. Of all companies, I don’t see anyone else. If shareholders think that a combination, and not independence, is better, then it will happen.”

From the services model that IBM follows, it makes sense to acquire a behemoth like SAP purely for its installed base and then sell all sorts of services to them. But the larger question is – what’s the room for growth here? From a software sales point of view, the market is pretty much saturated. My own view of the ERP behemoth is that given the utter complexity of something of the order of SAP/Oracle and the implicit insistence that the firm adapt to SAP’s version of reality – there is quite an opportunity for an intelligent class of enterprise software to make deep inroads.

Whatever the big honchos at IBM are thinking, I’m skeptical of such a merger simply because of revenues from any sort of installed base growth. The market space where there is some growth potential seems to be:

IBM and SAP have an existing partnership to bring ERP to the small and mid-sized company market. Penetrating these smaller companies has been a key marketing goal of SAP for the past few years.

The question is – why pick an elephant (or a sheared down version of an elephant) to run what needs to be, strategically and execution-wise, a nimble organization? Any new entrant in the enterprise software space needs to enter via the small and mid-sized company market because that’s where the behemoths are concentrating their efforts.

Old Chinese (Confucius) saying: “Do not use a cannon to kill a mosquito.”

This makes for an exciting few years ahead.

Tags: ERP, Rumors of merger between IBM and SAP, IBM, SAP, SCDigest

Dec 15, 2006 1

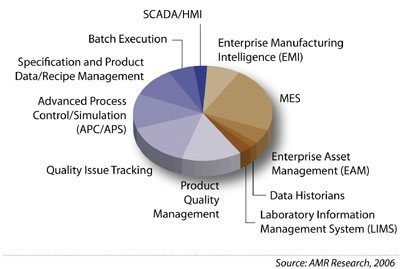

IndustryWeek reports on investment prioritization for manufacturing operations software and how it varies across different industry segments in a recent article titled – Different Priorities.

According to the report,

# In chemicals, 28% of the manufacturing budget will be applied to advanced process control and simulation.

# In aerospace and defense, 50% of the manufacturing budget will be applied to quality management systems.

# In pharmaceuticals, almost 45% of the manufacturing spending will be applied to quality management (if LIMS is included), 20% on recipe/formula/specification management and 20% on enterprise manufacturing intelligence (EMI).

# Automotive, high-tech and industrial products are prioritizing MES (29%, 32% and 35% respectively).

# The consumer products industry is spending the largest share of any industry’s manufacturing budget on EAM, at 16%.

The other interesting tidbit is captured in this pie graph:

As the report highlights, pharmaceuticals, aerospace and defense are trending towards quality management systems which is a sizeable market area to address if you were a provider of software systems. So the obvious question then is what are the quality management systems out there? Further, is quality management a COTS (Commercial Off-the Shelf Software) type of solution or something more substantial (and messy as well).

The second category of interest is MES (Manufacturing Execution Systems) which garners significant interest across the segments of automotive, high-tech and industrial products. The surprising (or perhaps, not so surprising) thing about MES is highlighted in this article here.

“In 2001 the vast majority of the Fortune 1000 manufacturers AMR Research surveyed were in the throes of massive ERP rollouts,” says senior research analyst Alison Smith. “As these draw to a close, manufacturers are realizing that their ability to effectively measure and manage the performance of their manufacturing assets hasn’t proportionately improved.”

What happened here – manufacturers are realizing that their ability to effectively measure and manage the performance of their manufacturing assets hasn’t proportionately improved? Is it simply that knowing what is happening doesn’t mean that you know what to do about it? Or is it just an informational glut of too many metrics that have not been pulled together into a coherent manufacturing execution philosophy?

The last category of interest is the advanced process control and simulation software as applicable to chemicals industrial segment.

One thing stands out in all these major categories of investment interest i.e. finding the silver bullet for business execution. These systems are central to the functioning of the business i.e. they are core systems. Even in the quality management systems of interest in the first category, I would argue that it is a core function of the firm. From this, there is an indication that the promises of ERP or similar systems have not actually panned out in actuality. That’s good to know because the need is still there.

Tags: Manufacturing Software, Investment Priority, AMR Research, IndustryWeek

Dec 4, 2006 0

In this addendum to the post – Artificial Intelligence in Supply Chains, I want to highlight a paper (part of a book on the subject) titled: Supply Chain Management and Multiagent Systems: An Overview published by Thierry Moyaux, Brahim Chaib-draa, and Sophie D’Amours available online here.

Tags: Artificial Integlligence, AI, Intelligent Agents, Multiagent Modeling

Dec 4, 2006 0

InformationWeek has a dated article about Artificial Intelligence making a foray into the Supply Chain Management space. The article by David M. Ewalt talks about how

Software makers such as IBM, i2 Technologies, Manugistics, and SAP are rushing to imbue supply-chain-management tools with artificial intelligence, allowing them to make better choices and even learn from mistakes.

Since the article is dated to April 2002, which is roughly 4.5 years ago, now would be an appropriate time to evaluate the progress made so far.

Have you heard anything remotely intelligent in Supply Chain Management from SCM software players? (Hah, haha!!)

On a more serious note,

Supply-chain-management programs are structured sort of like flow charts, following a make-and-sell model of supply and demand. Software that IBM Labs is building works more like bees in a hive, with lots of autonomous agents going out into the world collecting data. The result, says Grace Lin, a senior manager at IBM’s T.J. Watson Research Center, is a system that can more easily consider new sources of information. These “sense and respond” systems make their own decisions based upon the variables at hand and aren’t strictly confined to a set of rules.

Further as to what this AI would be doing,

IBM’s effort essentially gives the program artificial intelligence, so it compares current business conditions to historical ones and forecasts what’s likely to happen next. “It doesn’t just react, but anticipates,” Lin says. And based on what actually does occur, the program can compare its forecast against reality, learning if it made a mistake. Lin says she expects a finished prototype later this year and a commercial version within five years.

Its about 4.5 years since this article and so I went searching for an IBM AI based software that is either in its last developmental stages or commercially deployed for supply chain management.

Nov 13, 2006 2

REA (Resource-Event-Agent) is a semantic model for internet based Supply Chain collaboration developed by Dr. William McCarthy of Michigan State University. In this presentation for the ACM Conference on Object-Oriented Programming, Systems, Languages, and Applications (OOPSLA 2000), Dr. McCarthy and Robert Haugen, Logistical Software LLC outline a web-based semantic model for collaboration.

Before I dived into this thing – I asked myself what do these good people mean by using the word semantic in a semantic model for internet based supply chain collaboration? You can look up the definition here

se.man.tic: Spelled Pronunciation[si-man-tik]

– adjective

of, pertaining to, or arising from the different meanings of words or other symbols

Eg: semantic change; semantic confusion.

So in other words, a semantic model is really a language meaning based model. So, what do the authors mean by using the term sematic model?

By “semantic model” we mean a computer software model of real-world supply chain activities. Another term for semantic model from the field of knowledge representation is “ontology”: the set of classes, relationships, and functions in a universe of discourse.

The authors also try to differentiate it from XML in the following way:

We use the term “semantic model” to differentiate from something like XML, the eXtensible Markup Language, which is often touted as the language of the semantic Web. XML is just a format; it has no content. A semantic model describes the content of the semantic Web: that is, what classes of objects, relationships, and functions are involved in supply chain collaboration. The REA semantic model can be expressed in many formats: XML, UML (the Universal Modeling Language), a relational database, and/or an object-oriented programming language. Using XML as the lingua franca, any REA-based system should be able to interoperate with any other REA-based system, because they understand business objects and events in the same way.

The authors also supply an outline of the aims of using the REA semantic model:

- supply chain collaboration requires a standard semantic model that all trading partners can use;

- to achieve Tim Berners-Lee’s vision (in other words, so that anybody can do business with anybody anywhere), the model must be a generally-recognized, non-proprietary Internet standard;

- the model must be broad (covering the whole supply chain) and deep (covering all relevant business activities);

- REA is the broadest and deepest currently available semantic model for supply chain collaboration;

- and REA is non-proprietary, in the public domain, open for developing into an Internet standard.

So what should the REA semantic model achieve in practical operational terms?

As a semantic Web, REA can link economic events together across different companies, industries, and nations. The links are activity-to-activity or agent-to-agent or person-to-person, not just company-to-company. This means each individual in a REA supply chain can be linked directly to each other individual.