Here’s wishing all of you and yours a Happy New Year – an exciting and fun-filled year ahead. Over the break, I’ve been doing some hard thinking about the direction of my life, career and blog. So I’m done with the thinking and now comes the execution – I’ll be making some changes to the blog and my life trajectory (and believe me this is going to come out of left field).

I’m still going to be blogging about the supply chain but I’m expanding my focus to the enterprise as a whole but a specific part of the enterprise that is undergoing a lot of exciting changes.

More of that to come in the days ahead…

I thought that I’d pass on to my readers a free guide (no registration required, no cookies taken, just click and read – doesn’t get better than that, does it?) on Spend Analysis made available by Michael at Sourcing Innovation.

Spend Visibility : An Implementation Guide

Have a great rest of the year…

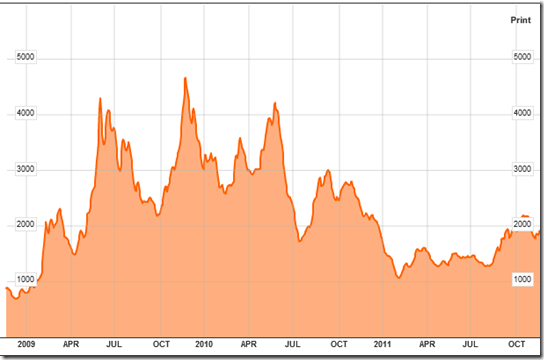

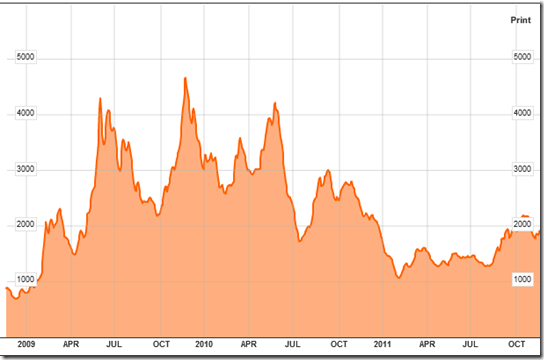

Periodically, I revisit the Baltic Dry Index (BDI) from time to time to get a read on economic activity as read from the volume of shipping contracted across the world. The following is a 3-year chart from 2009 onwards.

As you can see, the stimulus lead spurt of activity also reflected in the economy starting in early 2009 that began to peter out at the beginning of 2011. Then starting from August 2011, the index records a slight improvement in activity but nothing to write home about. While it is early to rule in an oncoming recession, it would take only the slightest worsening of the crisis in Europe to send all the economies of the world reeling once again.

No good news here. But as long as there’s no terrible news either, we slink on.

LogiCon 2012 is Europe’s only Retail and FMCG supply chain conference, bringing together 150 senior supply chain experts, to learn from over 37 insightful sessions and 35+ thought-leaders including Carrefour, ASDA, P&G, Unilever and Puig Group. THE place where the future of the supply chain is shaped, LogiCon helps supply chain professionals develop practical techniques to improve efficiency, agility and sustainability while driving customer service and lowering costs.

7th – 9th February 2012 at Radisson Blu Hotel, Amsterdam Airport, Schiphol.

Register today at www.logiconeurope.com

Apple’s succession story has been in the news lately – or rather a story made necessary by Steve Job’s health situation. In this article on CNET : Apply supply chain sees smooth sailing ahead, the new head of Apple – Tim Cook, is reputedly a supply chain pro. In one sense, that’s a great thing but then I take a step back and ask myself : Is that what Apple really is?

I don’t think of Apple as a supply chain company with great products but a company with great products that has honed its supply chain quite well.

There is one quote from a Jeffries Analyst that speaks to the supply chain management voodoo at Apple:

"Even with the unfortunate events in Japan around the time of the iPad 2 release, Tim Cook was able to double or sometimes triple source component suppliers. To date, no competitor has been able to gain meaningful share in the tablet market; and, in our view, Cook’s leadership during the introduction was critical to this."

Perhaps, we will see Tim Cook elevate the next avatar of Steve Jobs from within Apple’s ranks that puts the key competitive advantage of Apple front and center. That would be “Giving people what they didn’t even know that they needed”.

Not easy but necessary.

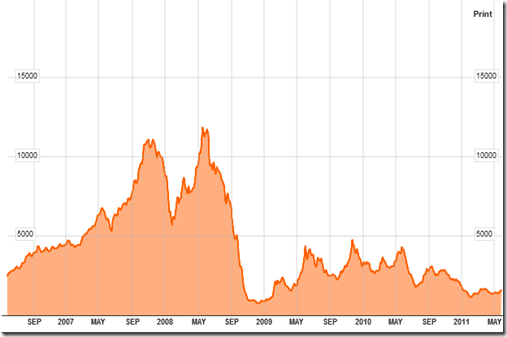

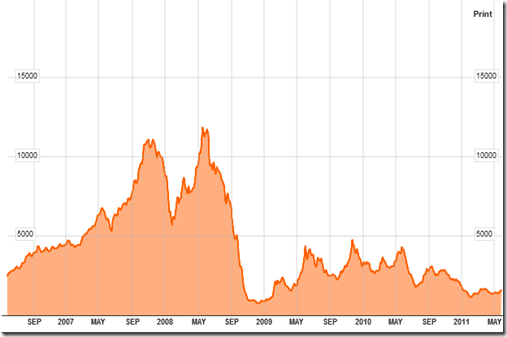

In an earlier post, I blogged about the Baltic Dry Index as a good indicator of economic activity (Read it here: Ready for a recession?)

Even if we were to magically start moving in the Baltic Dry Index in a positive direction which would be a tremendous relief for everyone (but remember – *magically*), the US treasury and the Federal Reserve would continue to devalue the US dollar for two practical reasons:

1) Repay outstanding debts with a depreciated currency. This is really quid pro quo with some of the trading partners of the US against whom the US has been running trade deficits for the better part of a decade. The whole point of trade is not for one side of the equation to accumulate a lot of paper currency but to reciprocate in buying the origin country’s exports.

2) Make US exports competitive with other countries and reignite production/manufacturing stateside.

In fact, if the US (and World) economy were to recover some what, the above two agencies would devalue the US dollar with a vengeance.

This sort of policy, if successful, would mean a repatriation of some of the manufacturing that went overseas. Going further, when US firms look at the scenario (albeit a few years down the line) and see that the assets created overseas for manufacturing whatever widgets were outsourced have depreciated or is in need of upgrades to remain viable, that would be the decision point for deciding where the next generation of manufacturing will be located.

Much of the trajectory of what we see taking place goes to answering that question of the future and the above two agencies are hell bent on creating conditions that answer this question of manufacturing in the positive.

Or so I believe.

In such a scenario, what I believe to be key to long term competitive manufacturing is the ability to be smart about manufacturing – it means being able to operate using a very thin buffer for error because American firms will be competing with overseas firms (firm benefiting from their own countries’ competitive devaluation) that will continue to compete on large volumes and scale.

So what is Smarter Manufacturing?

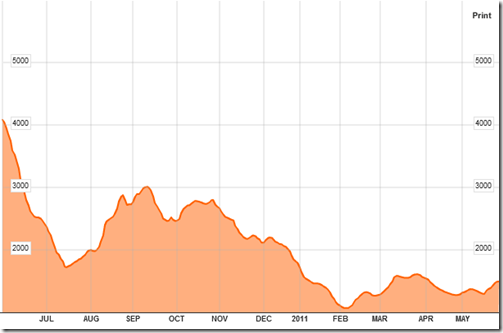

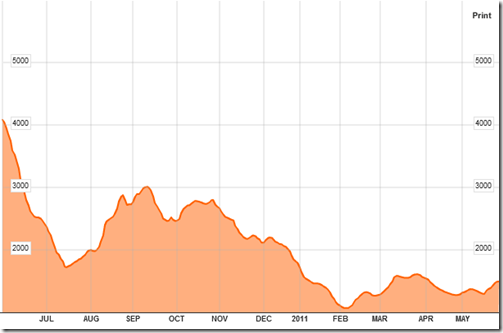

Are you ready for the coming Recession? “Why, when did the last one end”, you may ask me. And the truth is that it never ended. The below chart captures it quite well – this is a 1 year chart of the Baltic Dry Index (never heard of it? Well, now you have)

The Baltic Dry Index is best described as (Baltic Dry Index: BALDRY):

The Baltic Dry Index is a daily average of prices to ship raw materials. It represents the cost paid by an end customer to have a shipping company transport raw materials across seas on the Baltic Exchange, the global marketplace for brokering shipping contracts.

and

The BDI is one of the purest leading indicators of economic activity. It measures the demand to move raw materials and precursors to production, as well as the supply of ships available to move this cargo. Consumer spending and other economic indicators are backward looking, meaning they examine what has already occurred. The BDI offers a real time glimpse at global raw material and infrastructure demand. Unlike stock and commodities markets, the Baltic Dry Index is totally devoid of speculative players. The trading is limited only to the member companies, and the only relevant parties securing contracts are those who have actual cargo to move and those who have the ships to move it.

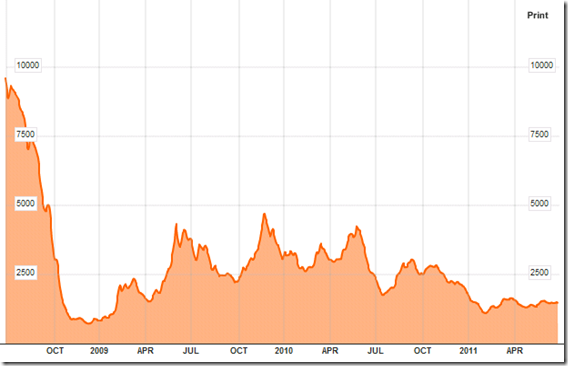

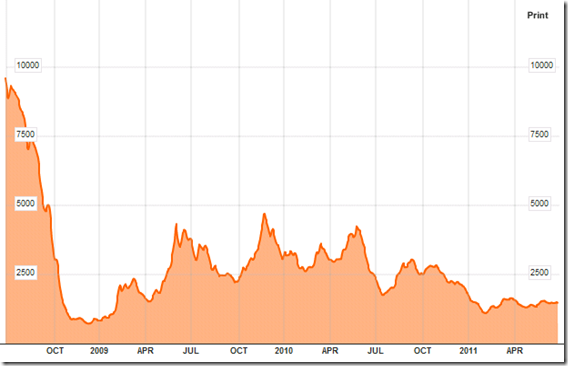

However, if you want to place in context the fluff about the US (or World) economy floated by your “favorite” news agency or administration spokesman – just pull up the 5 year chart of the Baltic Dry Index.

The aftermath of the Great Recession and consequent efforts to revive the US (and worldwide) economy is reflected in the period of mid-2009 to mid-2011. All that stimulus and confidence measures have largely achieved naught.

If the Baltic Dry Index meanders at the bottom of the chart above on a go forward basis – then there is a great likelihood that the Great Recession from 2009 will resume with all its consequent effects.

Sorry folks – this is terrible news but forewarned is forearmed.