Apr 1, 2011 0

“Let them eat cake…”

At the rate at which I’m going – I’m posting one a month. And between my last post and this – It does seem that the world has gone mad. Or rather, very many maddening things are afoot that threaten to undo our current global project. It does seem to me that the “International” has begun to parlay into the “national” in a rather conspicuous way.

Be it the Earthquale-Tsunami-Nuclear Disaster than befell the Japanese or the popular uprisings and its very many diverse consequences in the Middle East or the non-existent economic recoveries in the developed world, I see a vortex into which everyone and everything will be dragged down for awhile. When everything is connected (and don’t we as those Supply Chain aficionados and evangelists bear some responsibility?), the perturbations and volatilities in the system threaten to drag everyone into it.

It is at this juncture that I happened to read two different same articles that morphed into the headline of this post – “Let them eat cake..”

So here they are:

Article 1: Wal-Mart CEO Bill Simon expects inflation

From the article, a few salient points:

U.S. consumers face "serious" inflation in the months ahead for clothing, food and other products, the head of Wal-Mart’s U.S. operations warned Wednesday.

and

Along with steep increases in raw material costs, John Long, a retail strategist at Kurt Salmon, says labor costs in China and fuel costs for transportation are weighing heavily on retailers. He predicts prices will start increasing at all retailers in June.

"Every single retailer has and is paying more for the items they sell, and retailers will be passing some of these costs along," Long says. "Except for fuel costs, U.S. consumers haven’t seen much in the way of inflation for almost a decade, so a broad-based increase in prices will be unprecedented in recent memory."

Article 2: Why Sustainability Is Winning Over CEOs

From the article,

Potatoes are 80 percent water, most of which is lost as steam when 350,000 tons of spuds are sliced and fried annually at the factory. Seal hopes to condense the steam, possibly with a system of cooling tubes, and reuse the captured H2O to clean equipment, help wash potatoes along manufacturing lines, and even irrigate the shrubs outside. The method could save the plant $1 million a year.

and

Executives are trying to realize meaningful cost savings by coming up with innovative ways to go easier on the environment.

Recent volatile price swings in plastic packaging, fuel, cotton, food ingredients such as corn, and a host of other raw materials have added urgency to businesses’ efforts to shave costs to keep prices competitive and protect margins.

To make matters worse, the water that would have run-off in the potato processing would have returned to the “environment” – How this goes easier on the environment is beyond me? Further in the article, there is talk about savings from reduced packaging and conversion of transportation options to electric vehicles.

Why do I say that this is the “Let them eat cake…” moment? In the offing, is an unprecedented wave of cost increases across the board because of the Federal Reserve (working in concert with other Central Banks) engineered inflation. And in the face of it, are we to sit back happy that the captain’s of industry are enamored of cost-savings through sustainability.

The Fed has won in the sense that it is on the verge of getting what it engineered – inflation.

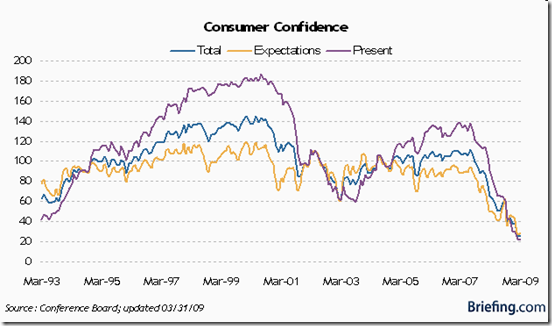

What my reader has to do is to connect the dots. Because you see, the people in the Middle-East are not up in arms because they’ve been living under dictatorships but because living under a dictator has become intolerable of late. But why has life under dictatorships become intolerable for them? Too often, when you see the alphabet soup news media (ABC, CBS, CNN, NBC, FOX et al), you don’t get the whole picture. Life is intolerable because the ordinary man can’t afford the price of food (let alone anything else) there.

The following chart can be found : Egypt Inflation data

The real challenge of the coming years is not Sustainability or saving the planet – It will be saving the globalization project itself. And our own projects of the supply chain are quite inextricably linked with that globalization project.