Aug 14, 2013 1

The Oh-no moment…

I couldn’t resist the pun. Long time readers of the blog would know very well that the insights of Taiichi Ohno hold a special place in my corpus of intelligent and wise things to have around. So it is a rather “Deming – like” sort of conundrum to have at hand an Oh No!! moment from Japan itself : Bernanke just felt a chill down his spine.

If you are not plugged in into the vast array of paralyzing news that flows around you or perchance missed this rather telling problem that has arisen in Japan of late.

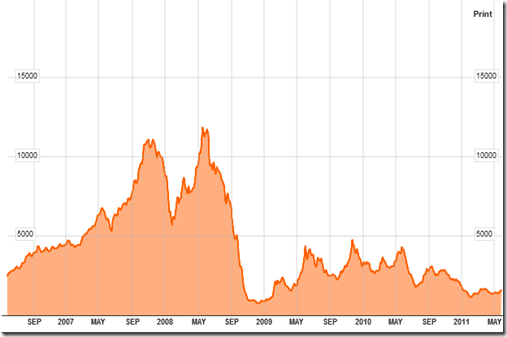

In April 2013, Japan announced a QE program of $1.4 trillion, an amount equal to roughly 25% of the Japanese GDP. To put this into perspective, the US’s QE1, QE 2, QE 3, and QE 4 programs which were spaced out over four years are an amount equal to roughly 16% of US GDP.

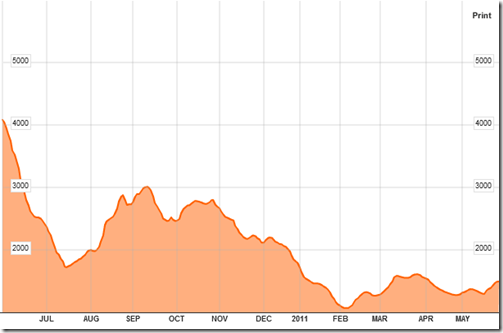

When people refer to QE (Quantitative Easing) by the central bank, they almost always refer to it as if it were the only driving factor in the land. You have to remember that both Japan and the US has been running budgetary deficits as well. For Japan, it looks like this : Japan Government Budget (as % of GDP).

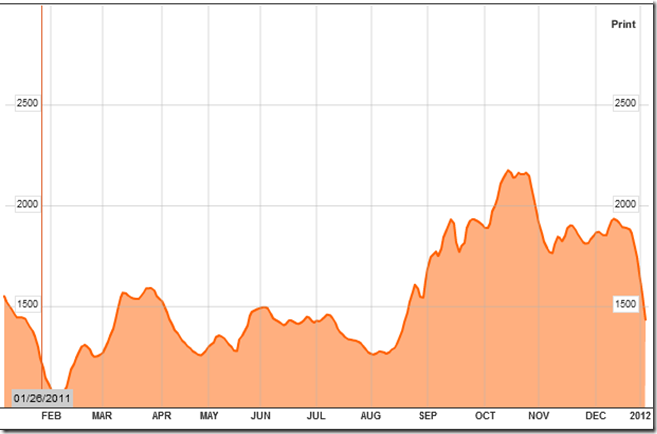

For the US, it looks like this : US Government Budget (as a % of GDP)

But,

Japan announced a larger program relative to its economy all at once. The idea was that by throwing around a big enough amount of money, Japan’s economy would finally waken from its 20-year slumber and take off.

This effort has been an abysmal failure. Japan’s second quarter GDP grew at just 0.6% quarter over quarter, registering the single biggest growth MISS in a year (economists were expecting 0.9% which, by the way had already been revised lower).

Put in plain terms, Japan announced the single largest QE effort in history, and not only did its economic growth projections have to be lowered, but it is failing to even meet these lowered growth projections.

So, the noted result is that the GDP came in lower than the lowered forecast. For now. Oh no!!!

So what is supposed to happen?

The central bank – BOJ, Bank of Japan, being one of the bigger behemoths (financially speaking) in a country, can wish into existence more money which they then use to buy bonds. Why bonds and particularly govt. issued bonds? The point is that that’s where a lot of people have parked their monies because of the current state of the economy – accepting a nominal return in exchange for safety. By buying bonds with seemingly inexhaustible (though the only currency that is truly inexhaustible is stupidity but even a simple familiarity with the human being shows that they do get tired from time to time) i.e. magically created monies, the BOJ hopes to drive down the yield on the said bonds such that if people holding bonds currently felt that they were getting a whole lot of safety, they were going to get even less return for that safety. Ergo, those monies would be then retrieved and ploughed back into comparatively riskier assets such as stocks (i.e. the preferred funding mechanism for new ventures) which then leads to hiring instead of firing and so on.

Except that the GDP measure that is supposed to show the increase in “virtuous” activity that all this QE was supposed to engender has not worked out as well as one would have expected.

And so what is one to make of this?

Perhaps this Oh-No!! moment can lead us to what I appreciate as the central Ohno (the Taiichi kind) precept i.e. Respect for People. You see, when the BOJ (and as an agent for action, one cannot deal with a more ill-suited agent. In a firm, the BOJ would be the payroll + performance manager combined) wades onto the scene, the fundamental action is to whip people around, to coerce them into an action. You see the problem?

Let’s get something straight here – while stupidity is a truly inexhaustible resource in this world, between the ears of each and every human being is an explosive and creative engine. Unleashing this engine can only be contemplated as an extension of the inherent respect that every man, woman and child are inherently owed as their endowment.

All the machinations of central planners and allied commentators take the track of either, “Messing with/exciting the animal spirits”, or “Devaluing the efforts of people in the past i.e. through inflation” or the like.

As these Oh-No’s pile up, perhaps, it would be a wise thing to see how Ohno studied the matter in a factory on a small island far away…