May 31, 2011 1

Ready for a recession?

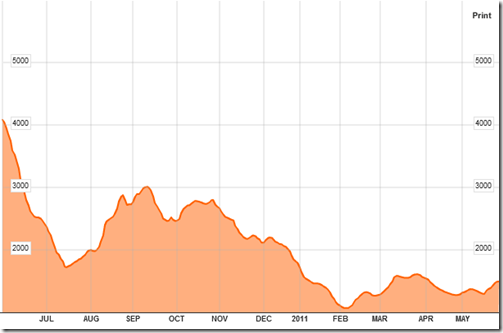

Are you ready for the coming Recession? “Why, when did the last one end”, you may ask me. And the truth is that it never ended. The below chart captures it quite well – this is a 1 year chart of the Baltic Dry Index (never heard of it? Well, now you have)

The Baltic Dry Index is best described as (Baltic Dry Index: BALDRY):

The Baltic Dry Index is a daily average of prices to ship raw materials. It represents the cost paid by an end customer to have a shipping company transport raw materials across seas on the Baltic Exchange, the global marketplace for brokering shipping contracts.

and

The BDI is one of the purest leading indicators of economic activity. It measures the demand to move raw materials and precursors to production, as well as the supply of ships available to move this cargo. Consumer spending and other economic indicators are backward looking, meaning they examine what has already occurred. The BDI offers a real time glimpse at global raw material and infrastructure demand. Unlike stock and commodities markets, the Baltic Dry Index is totally devoid of speculative players. The trading is limited only to the member companies, and the only relevant parties securing contracts are those who have actual cargo to move and those who have the ships to move it.

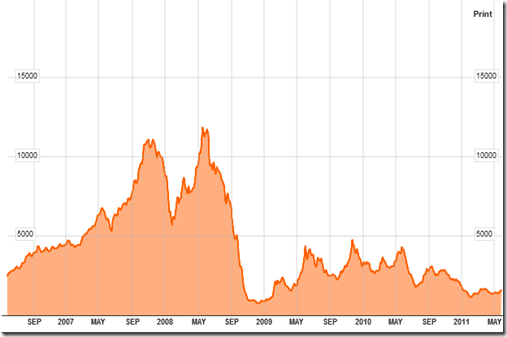

However, if you want to place in context the fluff about the US (or World) economy floated by your “favorite” news agency or administration spokesman – just pull up the 5 year chart of the Baltic Dry Index.

The aftermath of the Great Recession and consequent efforts to revive the US (and worldwide) economy is reflected in the period of mid-2009 to mid-2011. All that stimulus and confidence measures have largely achieved naught.

If the Baltic Dry Index meanders at the bottom of the chart above on a go forward basis – then there is a great likelihood that the Great Recession from 2009 will resume with all its consequent effects.

Sorry folks – this is terrible news but forewarned is forearmed.