Apr 27, 2010

Two conflicting reports : Who decides?

The first report is from March 3rd of this year:

Panjiva cites decline in global shipments to U.S. from January to February. From the article,

There was a 3 percent decline in the number of global manufacturers shipping to the United States from January to February, according to data from Panjiva, an online search engine with detailed information on global suppliers and manufacturers.

This comes on the heels of a 3 percent decrease from December to January, a 3 percent gain from November to December, and a 1 percent decline from October to November. The 3 percent decrease from January to February is considerably better on a year-over-year basis, when there was a 10 percent decline.

and,

Panjiva also noted that there was a 4 percent decrease in the number of U.S. companies receiving waterborne shipments from global manufacturers. This follows a 7 percent decline from December to January and a 2 percent gain from November to December.

Panjiva CEO Josh Green commented in a blog posting that some caution needs to be exercised when viewing this data, as they are "somewhat misleading" due to global trade being in free fall last year at this time, coupled with the fact that "the absolute level of global trade activity remains well below where we were prior to the 2009 recession."

In an interview with LM, Green said that while it is a positive thing that global trade has emerged from the depths of the recession, Panjiva’s data suggests that global trade is following a seasonal path, although it is not returning to pre-recession levels. This, said Green, raises the question of whether or not what is currently happening is the new normal."We are moving sideways now and are not truly in a robust recovery," said Green. "The signs [of a true recovery] are not there yet. But we are not in panic mode anymore either."

Now, here is a report from yesterday from the New York Times: From the Mall to the Docks, Signs of Rebound

The docks are humming again at this sprawling Pacific port [Oregon], with clouds of golden dust billowing off the piles of grain spilling into the bellies of giant tankers.

In Portland, Ore., Kevin Weldon prepared soda ash for export. Exports rose in the first two months of the year by nearly 15 percent compared with a year earlier.

“Things are looking up,” said Dan Broadie, a longshoreman. No longer killing time at the union hall while waiting for work, instead he is guiding a mechanized spout pouring 44,000 tons of wheat into the Arion SB, bound for the Philippines.

and,

Exports swelled in the first two months of the year by nearly 15 percent compared with a year earlier, according to the Commerce Department.

Now, that’s two reports from two different sources that could be reconciled by some neat trick but what is that trick? Animal spirits? No, something more shocking – Imports are down and exports are up? Huh, what? Now, that’s a welcome change, one would think.

But Animal spirits are everywhere,

“I’m certainly interested in spending now that the stock market seems so relaxed,” said Dan Schrenk, an information technology consultant, as he stood outside a Best Buy store in the Portland suburb of Beaverton.

and,

On the other side of the country, at the Garden State Plaza mall in Paramus, N.J., Marie Bauer, who sells clothing for a living, was feeling similarly emboldened.

“I’m working more now,” she said. “I bought myself a watch.”

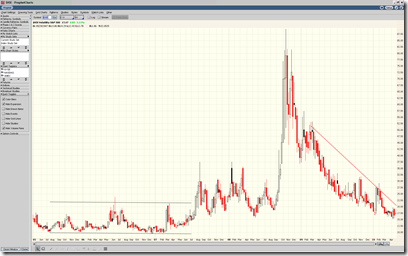

If that ain’t Animal Spirits, what is? One is boldly buying a watch. (a watch, mind you!!) while the other is calmed by the current state of the stock market. I suppose, I could be charitable and envision that it is not a Timex but a Rado but those are still imports in my book. As for the calm in the markets, that’s exactly how a sucking out of volatility from the market sounds and feels like. Look at the chart below:

When volatility is sucked out, there is much complacency in the market and the above quote is a good example of it. As the left side of the above chart shows, complacency can last quite a long time and so cannot be read to indicate that something altogether violent and volatile is impending.

At the cross-roads, which fork do you believe, let alone take?